Abstract

This section describes configuration steps for Tax Credit Reporting.

All tax credit information is reportable and exportable for custom reports. Employers who run WOTC checks for new hires are eligible for tax credits, when new hires meet certain WOTC criteria. Ad hoc reporting is accessible to users with permissions through the Report menu option in the Talent Suite Onboard application. Selecting the Onboard Report menu item navigates users to the Onboard administration portal to log in with eligible credentials.

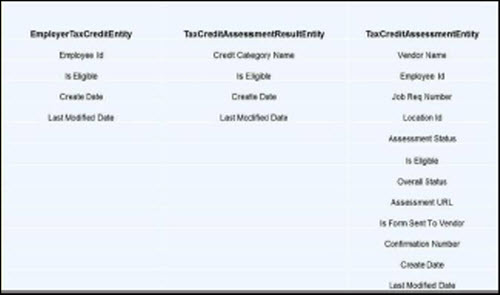

The following fields are available to add to a Tax Credit ad hoc report.

EmployerTaxCreditEntity

Employee Id

Is Eligible

Create Date

Last Modified Date

TaxCreditAssessmentResultEntity

Credit Category Name

Is Eligible

Create Date

Last Modified Date

TaxCreditAssessmentEntity

Vendor Name

Employee Id

Job Req Number

Location Id

Assessment Status

Is Eligible

Overall Status

Assessment URL

Is Form Sent To Vendor

Confirmation Number

Create Date

Last Modified Date

To access the My Reports screen:

In the Global Toolbar, display the Reports menu and then select My Reports.

Select the My Reports tab to display reports configuration options. The selected report displays with the configured columns and fields displayed.

Configure all columns and fields as required, then run the report. Note: When working with My Reports, selecting any custom/ad hoc report titles from the Show statement (such as any custom reports created by the logged in user) displays the report in the edit mode by default. It's suggested to use the Run Report button to load the report data faster. Use the Save and Run button to change reporting fields, or to reschedule the report. Custom reports are editable only by the creator of the report.

Note

Applicant-related fields are reportable along with tax credit information fields as a part of ad hoc reporting.