Abstract

Work Opportunity Tax Credit (WOTC) Ernst &Young Survey is a part of a new hire’s onboard tasks while onboarding in the Talent Suite. Tax credits are provided to employers for promoting the hiring of individuals from certain target groups who might face barriers to fair employment. WOTC checks are therefore required by employers to get a federal tax credit and secondly to promote workplace diversity.

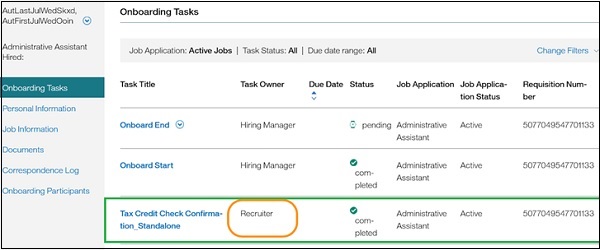

USE IN ONBOARD

Enhancements were made for Tax Credit Confirmation Check.

CONFIGURATION

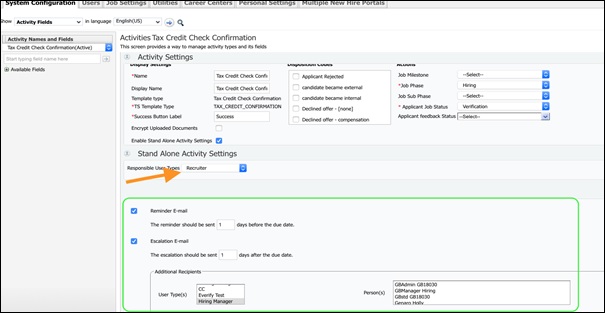

Manage Activity Fields screen: Responsible User Type is Recruiter:

Reminder E-mail

Escalation E-mail

Specifying the Responsible User Type

Scenario: Client opens a case where a standalone activity was generated for WOTC, but no Responsible User Type was selected.

If the Responsible User Type setting does not have one selected, by default, it is assigned to Primary HM for participants of that respective job.

Example: Standalone Tax Credit Confirmation Check is a standalone task automatically generated by the system based on the previous Tax Credit Check task completion response. For certain response statuses such as MANAGER_FORM_REVIEW_NEEDED/MANAGER_FORM_UPLOAD_REQUIRED, this standalone task is generated. Hxxxx Mxxxxxxx is selected as Primary HM in job participants and user type Recruiter.