- 27 Feb 2024

- 1 Minute to read

- Print

- DarkLight

Entering State Tax Withholding Information (New Hire)

- Updated on 27 Feb 2024

- 1 Minute to read

- Print

- DarkLight

Abstract

The Onboard application enables new hires to enter their state/local tax withholding information.

Regarding state tax withholding forms:

Onboard supports state forms for both U.S. and Canada.

Not every state uses a state tax withholding form. For example, Florida and Alaska have no state withholding.

Some states use Form W-4 as their state withholding form. For example, Pennsylvania uses Form W-4 as its state withholding form.

Some states use their own version of Form W-4 (and can have multiple forms). For example, New Jersey uses NJ-W4 as its state tax withholding form.

Depending on how Onboard is set up, a new hire's state of residence (state where the hire lives) or state of employment (state where the hire works) triggers the state tax withholding forms the hire must complete/sign/submit.

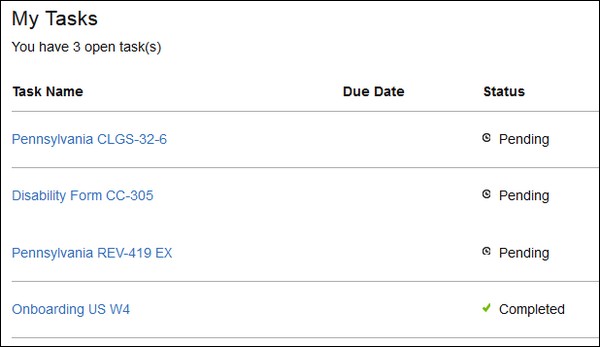

The various state tax withholding tasks show up in Onboard on the My Tasks page. Note: These tasks do not display until the new hire completes the Onboarding US W4 task.

For example, the following My Tasks page shows various Pennsylvania tax withholding forms.

When there are multiple tax withholding forms, the hire can:

Complete the tasks in any order.

Complete only the ones that are relevant to the hire, and skip the others (by using an Opt-Out button). For example, there could be a disability or military form that does not apply to the hire. With the Opt-Out button, the task status is marked as Opted Out, and cannot be reopened.

Opt-Out Button:

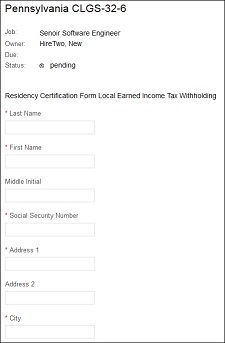

When the hire selects a state/local tax task, it displays on its own page. The following is a Pennsylvania local tax withholding form:

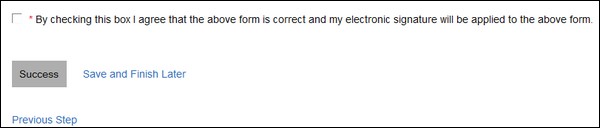

When all information is entered, and the tax form PDF is created, the new hire electronically signs the PDF (by selecting a check box that applies an eSignature), and submits it.