- 27 Feb 2024

- 2 Minutes to read

- Print

- DarkLight

Entering W-4 Information (New Hire)

- Updated on 27 Feb 2024

- 2 Minutes to read

- Print

- DarkLight

Abstract

The Onboard application enables new hires to enter their federal tax withholding information (needed for Form W-4).

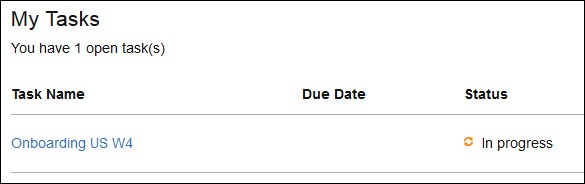

In Onboard, the task that allows a new hire to complete/sign/submit Form W-4 is called Onboarding US W4. The Onboarding US W4 task shows up in Onboard on the My Tasks page.

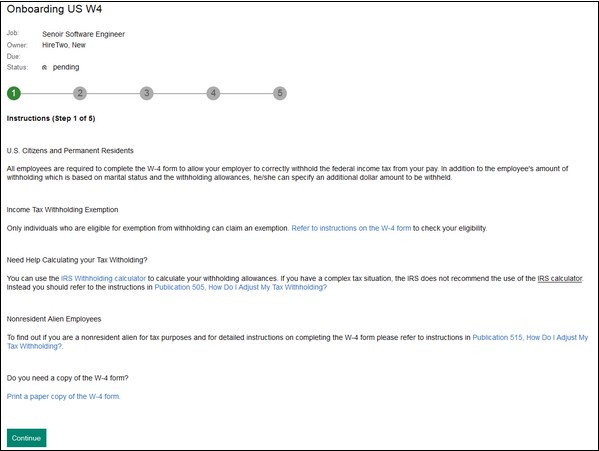

When the hire selects the Onboarding US W4 task, it displays on its own page.

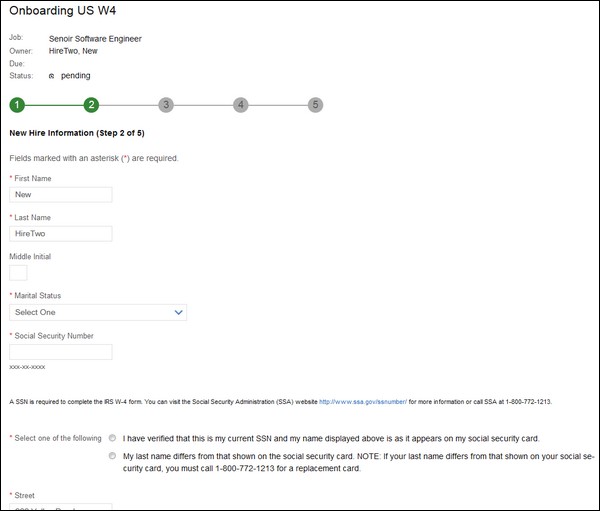

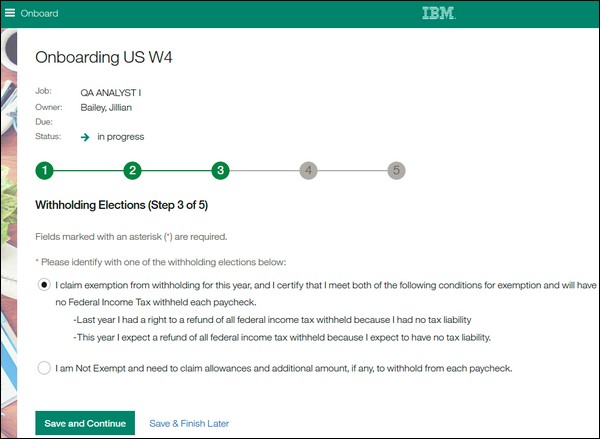

There are multiple pages needed to complete the Onboarding US W4 task. A W-4 wizard helps the new hire navigate through the steps:

Instructions

New Hire Information

Withholding Elections. Note: New hires can access the IRS Withholding Calculator from Step 3 when completing the W-4 form. When they select the link, a new window/tab opens and the IRS Withholding Calculator page displays.

Electronic Signature

Sign and Submit W-4 (Form W-4 PDF)

Note: State information in the new hire's profile automatically displays in the new hire's W-4 form. In addition to US State information auto-populating on the W-4, the new hire can choose Canada or Mexico manually, if relevant. Canada and Mexico do not auto-populate.

Onboarding US W4: Step 1 - Instructions:

Onboarding US W4: Step 2 - New Hire Information:

Onboarding US W4: Step 3 - Withholding Elections:

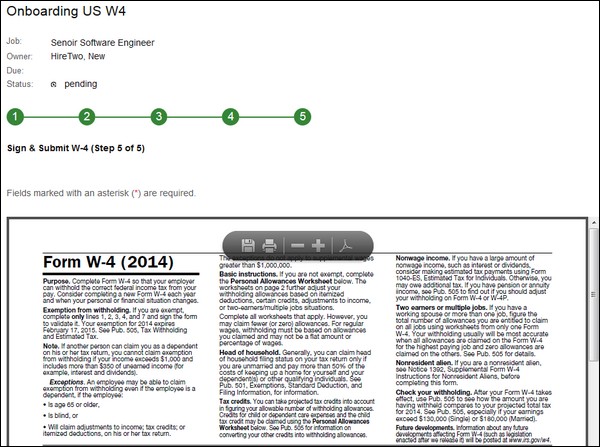

Onboarding US W4: Step 5 - Sign and Submit:

When all information on the PDF is verified, the new hire electronically signs the Form W-4 PDF (by selecting a check box that applies an eSignature), and submits it.

Note: The new hire must complete the Onboarding US W4 task before any state/local tax forms display on the My Tasks page.

FORM W-4 INFORMATION REGARDING NONRESIDENT ALIENS:

When completing Form W-4, nonresident aliens are required to:

Not claim exemption from income tax withholding.

Request withholding as if they are single, regardless of their actual marital status.

Claim only one allowance. Note: If the nonresident alien is a resident of Canada, Mexico, or South Korea, or a student or business apprentice from India, he or she may claim more than one allowance.

When completing Line 6 ([Additional amount, if any, you want withheld from each paycheck]), nonresident aliens must select a Non-Resident Alien (NRA) check box.

When the check box is selected, Line 7 [(I claim exemption from withholding...)] is disabled, and 0 is auto-populated in the Line 6 field.

The following link (by the check box) takes the user to [Supplemental Form W-4 Instructions for Nonresident Aliens]: https://www.irs.gov/pub/irs-pdf/n1392.pdf

A new text field allows new hires to enter their NRA status.

NRA statuses information is available in the [Determining Alien Tax Status] topic at: https://www.irs.gov/individuals/international-taxpayers/determining-alien-tax-status.

For Line 7 ([I claim exemption from withholding for 2019, and I certify that I meet both of the following conditions for exemption]), nonresident aliens cannot claim they are exempt from withholding (even if they meet both the conditions listed on that line).